Title loan success stories provide quick cash but hide potential traps like high interest rates and lengthy inspection processes. Borrowers should exercise caution, maintain financial discipline, and consider emergency funds to avoid debt cycles. Use these loans as a last resort after exploring alternatives, ensuring vehicle retention for collateral and peace of mind.

Uncover the secrets behind thriving title loan success stories, while learning to navigate common pitfalls. This comprehensive guide reveals the key strategies that borrowers employ to avoid costly mistakes, ensuring a positive experience. From understanding the fundamentals of title loans to mastering budget planning and selecting reputable lenders, you’ll discover how to make informed decisions. By following these principles, individuals can harness the benefits of title loans without falling into debt traps.

- Uncovering Common Pitfalls in Title Loan Stories

- Success Factors: Avoiding Costly Mistakes

- Strategies to Navigate and Win with Title Loans

Uncovering Common Pitfalls in Title Loan Stories

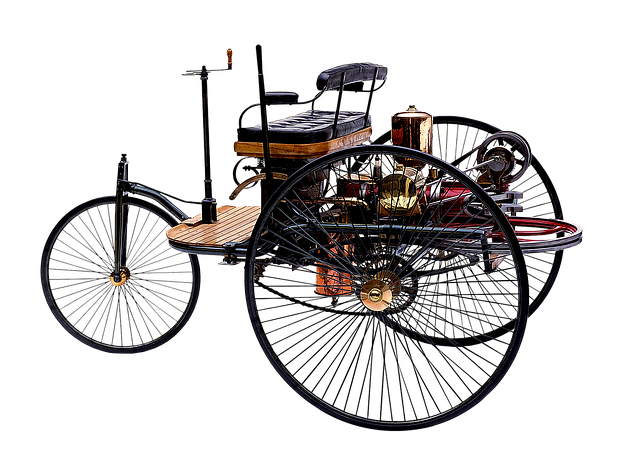

Many individuals seeking quick cash often turn to alternative financing methods, such as title loan success stories, where lenders offer loans using a vehicle’s title as collateral. However, it’s essential to recognize that these transactions come with potential pitfalls. Uncovering common traps is crucial for anyone considering this option.

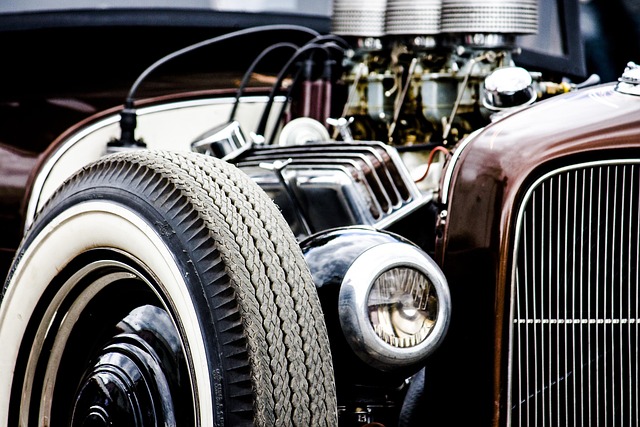

One of the primary concerns in title loan success stories is the high-interest rates associated with such loans. Lenders may lure borrowers with promises of fast approval and flexible terms but often hide astronomical interest rates, turning a small loan into a significant debt burden. Additionally, the process involves a thorough vehicle inspection to assess the car’s value, which can be a hidden cost if not clearly communicated. For instance, motorcycle title loans might require extensive documentation and meticulous examination, potentially causing delays and additional expenses for borrowers.

Success Factors: Avoiding Costly Mistakes

When it comes to Title loan success stories, understanding how to avoid costly mistakes is as crucial as recognizing winning strategies. Many individuals who have successfully navigated the process attribute their achievements to a keen awareness of potential pitfalls. One of the primary factors for success lies in maintaining financial discipline and ensuring emergency funds are in place before applying for any type of loan, including Fort Worth Loans. Unexpected expenses can quickly derail financial stability, making it essential to have a safety net. By setting aside a portion of one’s income specifically for emergencies, borrowers can avoid the temptation to turn to high-interest loans when unforeseen challenges arise.

Additionally, same-day funding, while appealing, should be considered with caution. While timely access to funds is a significant advantage in Title loan success stories, borrowing more than necessary or failing to budget for repayment can lead to a cycle of debt. Borrowers who approach these loans strategically, borrowing only what they need and creating a realistic repayment plan, are more likely to emerge from the experience financially secure.

Strategies to Navigate and Win with Title Loans

Navigating the world of financial solutions can be a complex task, especially when facing urgent cash needs. However, for many individuals seeking title loan success stories, this alternative lending option has proven to be a game-changer. By understanding and implementing strategic approaches, borrowers can navigate this process successfully and avoid potential pitfalls.

One key strategy is to approach title loans as a last resort, ensuring that you’ve explored other avenues first. These loans are designed for short-term financial needs, offering quick access to funds by using your vehicle’s title as collateral. When considering bad credit loans or options with no credit check, remember that keeping your vehicle as security is essential. This not only provides a safety net but also ensures you retain full use of your asset during the loan period, allowing for continued financial stability and peace of mind.

In exploring Title loan success stories, it’s clear that understanding common pitfalls and implementing effective strategies are key. By steering clear of the traps highlighted in this article—from meticulous planning to transparent communication—borrowers can navigate title loans with confidence and achieve their financial goals. Remember, success lies not only in securing a loan but also in maintaining financial health post-loan.