Unconventional Title Loan Success Stories: Transforming Struggles into Assets

Borrowers facing financial hardships have found relief through title loan success stories, leveragin…….

In an era defined by dynamic economic landscapes and evolving financial solutions, the concept of “Title Loan Success Stories” has emerged as a powerful tool for individuals and businesses seeking rapid access to capital. This comprehensive guide delves into the world of title loans, exploring how these innovative financing mechanisms have transformed lives and industries worldwide. We will unravel the intricacies, uncover success stories, and analyze the factors driving their impact. By the end, readers will grasp the potential of title loans as a viable alternative financing option and understand the diverse paths to achieving financial success.

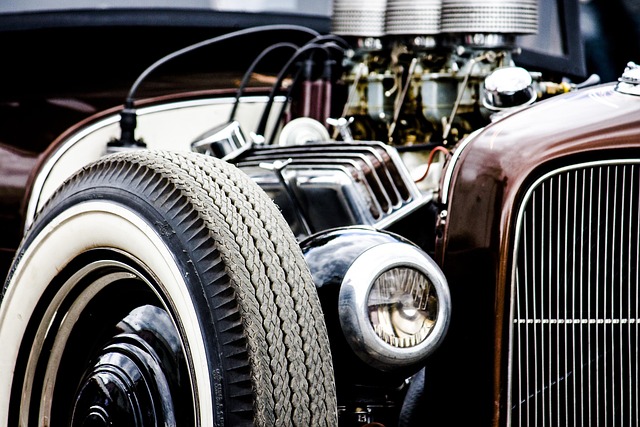

Definition: A title loan is a form of secured lending where an individual or business uses their vehicle’s (or another asset) title as collateral to secure a loan. The lender provides cash based on the value of the titled asset, offering a quick and accessible solution for those in need of immediate financial support.

Core Components:

Collateral: The primary security for the loan is the title of an asset, typically a vehicle, real estate property, or valuable equipment.

Loan Amount: Lenders assess the value of the collateral and offer a loan amount determined by this valuation. The funds can be used for various purposes, from business expansion to emergency expenses.

Interest Rates and Terms: Title loans are often characterized by relatively higher interest rates due to the short-term nature of the loans. Repayment terms vary but typically range from several months to a year.

Quick Turnaround: One of the most appealing aspects is the swiftness of the process. Applicants can receive funds within hours after approval, making title loans ideal for urgent financial needs.

Historical Context: The concept of using asset titles as collateral for loans has ancient roots, but modern title loan practices emerged in the 20th century with the growth of consumer finance industries. Over time, these loans have evolved to cater to a broader range of borrowers and uses, contributing to their success and popularity.

Significance: Title loan success stories are significant for several reasons:

The influence of title loan success stories extends far beyond national borders, with key trends shaping their global impact:

| Region | Trends | Impact |

|---|---|---|

| North America | Rapid digitalization of the process, leading to online title loan services. | Increased accessibility and convenience for borrowers, allowing them to apply from anywhere. |

| Europe | Growing acceptance as an alternative to traditional banking, especially in countries with less robust financial infrastructure. | Provides financial inclusion for populations previously excluded from mainstream credit options. |

| Asia Pacific | High demand due to the region’s rapid economic growth and increasing number of vehicle owners. | Significantly supports business expansion and personal investments during periods of rapid development. |

| Middle East & Africa | Emerging as a crucial source of short-term funding for small businesses and entrepreneurs. | Contributes to the rise of local enterprises and fosters economic growth in emerging markets. |

Title loan markets exhibit unique characteristics, influenced by factors such as regional economic conditions, credit availability, and consumer behavior:

Title loans have emerged as an attractive investment option for financial institutions and private investors:

Technology has revolutionized the title loan industry, enhancing efficiency, security, and accessibility:

The regulatory landscape surrounding title loans plays a critical role in protecting borrowers and ensuring fair practices:

Despite their benefits, title loan success stories are not without challenges and criticisms:

Addressing Challenges: To overcome these issues, policymakers and industry stakeholders should consider the following:

A young farmer, Sarah, in a rural community needed capital to expand her livestock operation. Traditional banking options were limited due to her lack of collateral and credit history. She turned to a local title loan provider, using her truck as security. The quick turnaround time allowed Sarah to purchase additional breeding stock, increase production, and diversify her revenue streams.

Lessons Learned:

Maria, a single mother in Berlin, faced unexpected medical bills for her critically ill child. With no savings and limited insurance coverage, she explored alternative financing options. A title loan seemed like the only viable option, as it required no credit check and offered quick cash. She used the funds to cover immediate medical expenses and repaid the loan over several months without incident.

Key Takeaways:

In Beijing, Li, an aspiring entrepreneur, needed capital to launch her dream restaurant. She secured a title loan using her car as collateral, gaining the necessary funding for startup costs, including lease deposits and equipment purchases. The swift process allowed her to open the doors of her successful establishment within months.

Insights:

The landscape of title loan success stories is poised for further growth and evolution:

“Title Loan Success Stories” represent a dynamic and influential segment within the global financial landscape, offering unique solutions to diverse financial challenges. From empowering entrepreneurs to providing relief during emergencies, these loans have proven their worth in countless real-world applications. By addressing economic needs, embracing technological advancements, and navigating regulatory frameworks, title loans continue to evolve as a powerful tool for financial inclusion and opportunity.

Q: Are title loans suitable for everyone?

A: Title loans are designed for individuals or businesses with valuable assets that can serve as collateral. While they offer access to capital, not all borrowers qualify due to factors like poor credit history or inadequate asset valuation.

Q: How quickly can I get a title loan?

A: The turnaround time varies but typically ranges from a few hours to one business day. Online applications and streamlined processes contribute to the speed of approval.

Q: What if I default on my title loan?

A: In case of default, lenders may initiate repossession procedures according to legal frameworks. Collateral forfeiture is a risk, but borrowers should understand their obligations to avoid potential consequences.

Q: Are there any alternatives to title loans?

A: Absolutely. Alternatives include personal loans from banks or credit unions, peer-to-peer lending, and government-backed small business financing programs, each with its own set of requirements and benefits.

Q: How can I ensure I’m getting a fair title loan deal?

A: Compare multiple lenders, understand the terms and conditions, and ask about fees and interest rates. Reputable lenders provide transparent information, ensuring borrowers make informed decisions.

Borrowers facing financial hardships have found relief through title loan success stories, leveragin…….

Title loan success stories offer a promising outlook for individuals seeking short-term financial so…….

Title loan success stories provide quick cash but hide potential traps like high interest rates and…….

Small businesses turn to title loans for growth, leveraging equity for capital access. Real-world su…….

Title loan success stories revolve around responsible borrowing and strategic financial management……..

Title loan success stories abound as alternative financing, secured by vehicle equity, provides quic…….

Borrowers leverage creative car title loan strategies for title loan success stories, offering quick…….

Title loan success stories rely on transparency, fairness, and clear communication from lenders in S…….

Title loan success stories humanize these loans, showing how real individuals use them as short-term…….