Title loan success stories showcase individuals using vehicle equity to access flexible, non-traditional financing. By avoiding strict credit checks and embracing customizable payments, borrowers gain stability and control during tough times. Fort Worth Loans assists clients in making informed decisions, extending loans with minimal asset sacrifice, and fostering responsible financial management.

“Discover how title loans, often overlooked, can be a powerful tool for financial stability in unexpected places. This article explores real-life title loan success stories, shedding light on how these unique lending solutions have transformed lives. From uncovering hidden financial strengths to empowering individuals to overcome challenges, we delve into the positive impact of title loans. Read on to navigate the often-misunderstood world of title loans and learn about the redemption and stability they bring.”

- Uncovering Hidden Financial Strengths: Real-Life Title Loan Stories

- Navigating Challenges: How Title Loans Bring Stability

- Empowering Individuals: Success Tales of Title Loan Redemption

Uncovering Hidden Financial Strengths: Real-Life Title Loan Stories

Many individuals often overlook their own financial strengths, assuming they lack options when facing sudden financial strains. However, real-life title loan success stories showcase a different narrative. These stories highlight how people with seemingly limited resources have successfully navigated through challenging times using alternative financing methods like title loans. By tapping into the equity of their assets, they’ve accessed much-needed funds without the strict requirements of traditional bank loans, including a thorough credit check.

Uncovering hidden financial strengths is not just about securing a cash advance; it’s about regaining control and making informed decisions. The flexibility offered by title loans, with their customizable flexible payments, allows borrowers to manage their finances more effectively while working towards long-term stability. These success stories serve as inspiration for others, demonstrating that even with a less-than-perfect credit history, there are options available to overcome financial obstacles and build a brighter future.

Navigating Challenges: How Title Loans Bring Stability

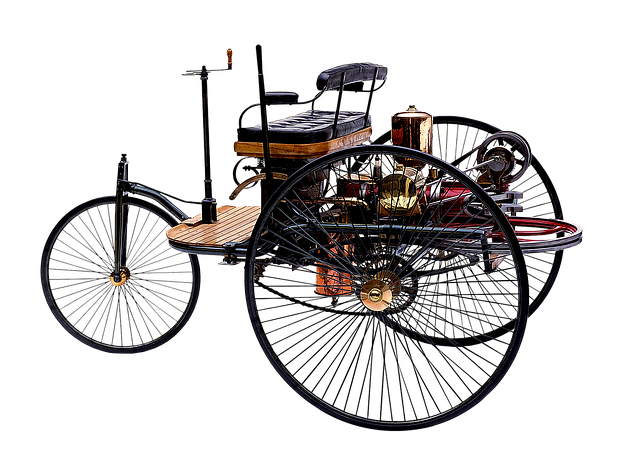

Navigating financial challenges can be a daunting task, but for many individuals, a title loan success story offers a beacon of stability and hope. These loans, secured by an individual’s vehicle title, provide a unique opportunity to access much-needed funds during difficult times. One of the primary advantages is their ability to offer flexibility in both terms and conditions, especially compared to traditional loan options.

The title loan process involves a quick vehicle inspection to determine the value of the asset, followed by an assessment of the borrower’s financial health. Lenders understand that life is unpredictable, so they structure flexible payments to accommodate various income streams and unexpected expenses. This adaptability ensures borrowers can maintain their stability while gradually repaying the loan without the added stress of strict deadlines or penalties.

Empowering Individuals: Success Tales of Title Loan Redemption

In the realm of financial empowerment, title loan success stories stand as powerful narratives that defy stereotypes often associated with short-term lending. These tales offer a glimpse into how individuals have successfully navigated challenging circumstances and achieved stability through strategic utilization of title loans. Fort Worth Loans, for instance, has witnessed countless clients transform their financial fortunes by exercising their right to access equity embedded in their assets, such as vehicles.

One common thread weaves through these success stories: responsible borrowing and timely repayment. Many borrowers opt for loan extension options rather than defaulting, allowing them to spread out payments over a longer period while maintaining control over their assets. Additionally, the process of title transfer plays a crucial role in these redemption arcs, enabling individuals to unlock immediate financial relief without sacrificing long-term asset ownership. These stories serve as a testament to the transformative potential of informed financial decisions and responsible lending practices.

Title loans have proven to be a powerful tool for individuals seeking financial stability. By uncovering hidden strengths and navigating challenges, many have achieved redemption through these unique lending solutions. Real-life success stories highlight how title loans can empower folks to overcome obstacles and rebuild their financial future, demonstrating the positive impact that responsible access to capital can have on lives.